Threshold ages and automatic adjustment mechanisms in PAYGO pension systems

Pay-as-you-go (PAYGO) pension systems are problematic: commitments are meant to be long term, but reality changes rapidly, which forces a frequent revision of rules. Gustavo De Santis suggests an alternative approach: a series of automatic adjustment mechanisms (AAMs), such that the need to revise rules emerges only rarely, if ever. Technically difficult, but not impossible. Whether it would also be socially acceptable is a different story.

Pension systems serve several purposes, the most important of which is probably to protect citizens from the risk of surviving to old age with consumption needs but no, or insufficient, income. However, there are also other objectives (e.g. “rewarding” past commendable behaviours, such as paying contributions, serving the country, or performing arduous or dangerous jobs) and various constraints, especially a balanced budget, which is particularly difficult to guarantee in a world where commitments are long term, but the demo-economic scenario keeps changing unpredictably.

This contradiction can be resolved in one of two ways:

1) Either some kind of pension arrangement is set up, which seems to work decently for the time being. However, despite inevitable bombastic assertions as to its “historical” character, everybody knows that things will soon get out of balance, and a change of rules will prove necessary, at the very least to address population ageing, probably the single most important driver of disequilibrium in the long run;

2) Or a self-adjusting pension system is set up, one that can always work, come what may, and guarantee certain predefined (and important) results.

Solution #1 is, by far, the one that societies seem to prefer in practice. Indeed, it is the only one that has ever been adopted, to the best of my knowledge, and it is also the reason why changes in pension legislation are so frequent (see e.g. OECD 2023, pp. 63 onwards). We are so used to this type of setup that most observers think that no other way is possible, in part because no viable alternative is in sight and in part because they deem that things may, in fact, be better like this. After all, all over the world, it is normal for rulers (parliaments, governments…) to issue all sorts of new laws, reflecting in part current circumstances and in part the prevailing “spirit of the age”. Why should pension laws be any different, and based on rules written in stone?

The specificity of pensions systems

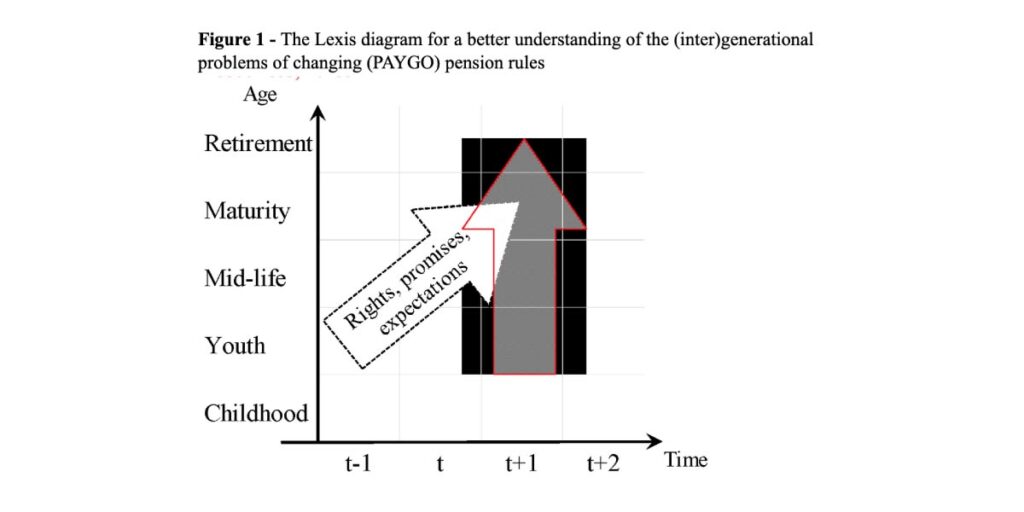

Well, there are indeed a couple of reasons why pension laws should be revised rarely, if ever, and both relate to the fact that the Lexis diagram is constantly at work in this field (Figure 1). In pay-as-you-go (PAYGO) pension systems, the only type discussed here, money flows cross-sectionally: each year contributions are paid (by working adults) and converted into pension benefits, received by retirees (red arrow). However, and here comes the black arrow, subjective expectations, individual balance sheets of contributions and benefits, and the very spirit of pension laws act longitudinally: “Pay this now, you will receive that in the future”. Rule changes renege on past promises, and, while necessary to keep the system on track (with an approximate balance between income and expenditure), they undermine people’s trust in the institution and, ultimately, in democracy. This will result in protests; hopefully, they may be peaceful ones, but voters will remember this “betrayal” at the next elections.

Besides, it’s not just about breaking promises: there is also a serious issue of (inter)generational equity and equality, and this is the second reason why pensions rules should not be changed without very good reason.

Ignoring, for the sake of simplicity, the problem of the changing value of money (e.g. due to inflation), or, if you prefer, reasoning in “real terms”, let us imagine that the members of a given birth cohort paid 100 in contributions during their active lives. Upon retirement, they should receive a pension of 100, and get back what they gave. However, if pension rules need to be revised (and benefits cut), one or more birth cohorts will receive less than their due and thus be treated unfairly, both within the cohort itself and in comparison with others. For each fiscal year (red arrow) everything seems to be well-balanced, but longitudinally (black arrow) this may result in unwarranted gains for some birth cohorts and losses for others.

What’s the alternative? AAMs and PAYGO

The alternative to rule-changing is to set a self-adjusting system, with constant rules that determine, in a known way, the necessary changes in the key variables of the system. Note that this idea does not exclude the possibility of ad-hoc adjustments: it merely makes them more rarely necessary (if at all).

And this notion does not come “out of the blue”: it expands on the recently developed idea of introducing automatic adjustment mechanisms (AAMs) in pension systems, aiming to resolve specific problems (e.g., what to do with retirement age when survival improves). The difference is that, while each AAM can address only one specific issue, a series of them could address many more – ideally all of them.

Of course, AAMs have their downsides. The first is that control seems to be lost over the dependent variable, the one that is automatically adjusted when the corresponding independent variable changes. In the previous example, retirement age will respond automatically to changes in life expectancy, and the result may be socially undesirable, e.g. increases may be too fast or, over time, excessive. In fact, the objection is much less compelling than it seems, because policy makers can always change the law if such tendencies emerge, which is no worse than having to operate in the absence of AAMs.

In all cases, most observers doubt that everything can be automatically adjusted and kept under control, given the large number of variables at play in the pension field: unemployment, labour productivity, inflation, population ageing, migration, etc.

IPAYGO

In fact, sometimes dreams (or nightmares?) come true. I recently proposed an improved version of a PAYGO pension system, called IPAYGO, which does precisely this: it predefines what society deems important (balanced budget, a certain trade-off between actuarial equity and redistribution towards the less well-off, etc.) and then adjusts automatically to obtain precisely the desired results, in all possible demo-economic scenarios (De Santis, 2024).

I have run out of space, and I cannot even start to describe my proposal, here. Let me just underline this: each year (cross sectionally, red arrow in Figure 1) the working population produces something, which can be thought of as a pie. Then, separately, there are claims on this pie, some of them deriving from “previous merits” (i.e. pensions: black arrow in Figure 1). A pension system is merely a complex transfer game, where nothing is produced, claims cannot exceed production in any given year, pensions take away resources from those who produced them, and the size of the pie is not known in advance.

The best that can be done in this context, in my opinion, is to predefine a set of rules on the socially acceptable relative share of this pie that can be allocated to all claimants, in such a way that claims sum up to 100%. No disequilibrium is ever possible (claims sum to 100 and therefore coincide with production), and the final result (who gets what) is the one that society has previously agreed upon.

Unfortunately, this is not how any actual pension systems function, and this is why imbalances emerge, deficits accumulate, and (painful) adjustments are frequently needed.

Funding

I acknowledge funding from Next Generation EU, in the context of the National Recovery and Resilience Plan, Investment PE8—Project Age-It: “Aging Well in an Aging Society”. This resource is co-financed by the Next-Generation EU (DM 1557 11.10.2022). The views and opinions expressed are my own and do not necessarily reflect those of the funding agencies.

References

De Santis G. (2024) Demography, Economy and Policy Choices: The Three Corners of the Pension Conundrum. Statistics, Politics, and Policy, online first. https://doi.org/10.1515/spp-2023-0013OECD (2023) Pensions at a glance 2023, Paris.