Demographic dividend in Africa: macro- and micro-economic effects

A fashionable but controversial concept

The ‘demographic dividend’ has become a fashionable concept over the past 20 years, and was the focus of the recent UAPS conference held in South Africa in December 2015.

The trend was set by a group at the Harvard School of Public Health, around David Bloom and David Canning, who wanted to promote family planning by highlighting its potential economic advantages. To this end, they showed the virtuous paths followed since the 1960s by East-Asian countries, which simultaneously reduced fertility levels and stimulated economic growth [Bloom et al. 2000, 2002].

The demographic dividend emerges when the age structure is conducive to economic growth, i.e., when the ratio of consumers to producers is low. The choice indicator of this age structure is the ratio of the population under-15 and over-65 (the inactive population) to the population aged 15-64 years (the active population), called the ‘dependency ratio’. However, this dependency ratio has a purely demographic definition and might differ from the precise relationship between consumers and producers, as it does not take into account duration of education, age at first employment, periods of unemployment, and age at retirement: it assumes that all 15-64 year olds are in employment. On the other hand, it is easy to calculate, and is comparable between countries and between periods.

Macro-economic rationale

The macro-economic rationale behind the concept of demographic dividend is that with a more favourable age structure – when the dependency ratio declines as a result of fertility decline or immigration – savings and investment will increase and economic growth will be higher. This mechanism necessitates a fully functioning banking system, able to convert increases in labour productivity and savings into economic growth [Barro 1997; Coale & Hoover 1958; Easterlin 1967; Johnson & Lee 1987; Kelley & Schmidt 1996; Mason 1988] and needs to be verified empirically in each country, over time.

Instead, empirical evidence of the dependency ratio brought by the Harvard group is only cross-sectional: it establishes a correlation between the dependency ratio and the economic growth of countries at a given point in time, which is different from the longitudinal perspective. Cross-sectional evidence from Asia invariably shows the expected correlation between a favourable dependency ratio and economic growth because countries which controlled fertility early, and therefore have a lower dependency ratio, were also those which followed favourable economic policies, and therefore have higher economic growth. This is above all a temporal correlation due to concomitant events, and not a functional relationship.

However, when the same countries (Korea, Taiwan, Thailand, etc.) are considered longitudinally, the correlation disappears or even changes sign. The periods between 1950 and 2010 when economic growth was highest were not those when the dependency ratio was lowest: in most cases the longitudinal correlation was nil, or contrary to expectations. The main reason seems to be that economic growth was primarily due to foreign investments and exports, and not to national savings. There is, however, a counter-example, that of China, where the longitudinal correlation between 1950 and 2010 was as expected (ρ= −0.98), i.e. low economic growth in periods with a high dependency ratio (e.g. 1950-1970), and conversely, high economic growth when the dependency ratio was low (e.g. 1990-2010). Although this correlation might again be due to historical processes, it could also be a direct effect, since economic growth in China was primarily endogenous and due to national savings, mainly forced savings due to low wages.

Demographic dividend in Africa

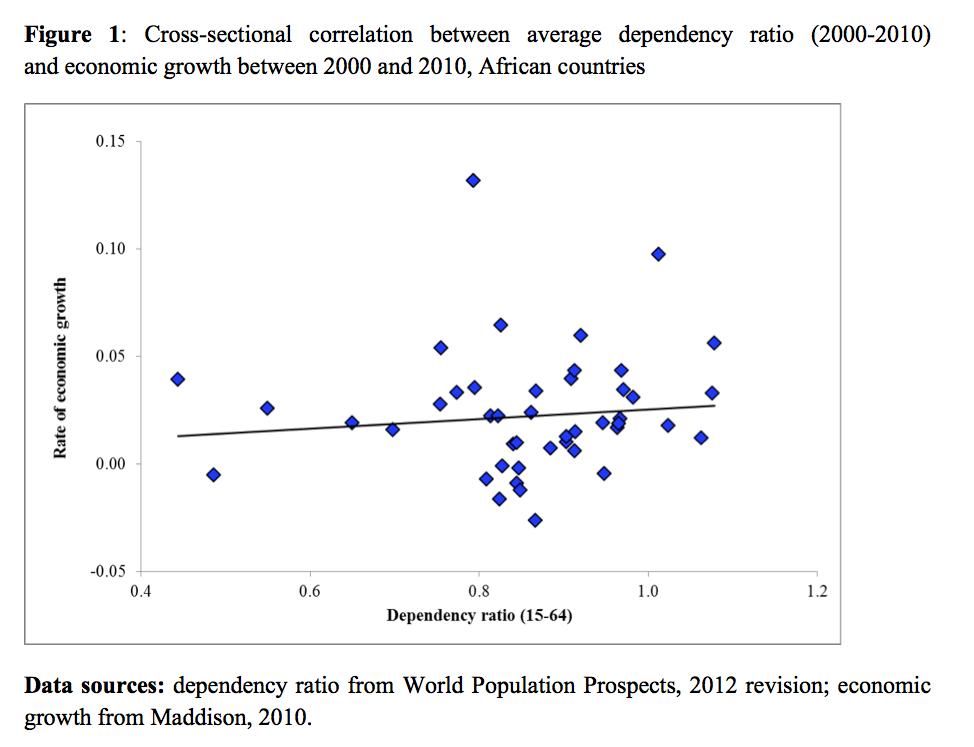

Empirical evidence in Africa poses even more problems [Garenne 2016a,b]. In cross sectional data over the 2000-2010 period, the correlation between economic growth and dependency ratio appeared slightly positive (ρ= +0.031), contrary to expectations. This is because the countries which limited their fertility early (e.g. Southern Africa) are more developed and have lower economic growth, while others have higher economic growth, thanks to high prices of export goods (oil in particular), or international investments and transfers (Figure 1).

In a longitudinal perspective, between 1950 and 2010, the correlation between economic growth and the dependency ratio was only mildly negative (ρ= −0.19), probably for the same reasons: most of the economic growth in African countries was due to exogenous factors, other than national savings: foreign investments, international aid, transfers from migrant workers, exports of primary commodities (oil, gold, diamonds), exports of agricultural products (cocoa, coffee, tea, palm oil, fruits, etc.). Out of 46 African countries investigated from 1980 to 2010, 16 had an unexpected positive correlation between economic growth and dependency ratio. One of the rare examples of the expected relationship is Mauritius, where the dependency ratio declined from 0.95 in 1950-59 to 0.44 in 2000-09 while economic growth rates increased from 11 to 39 per 1000 over the same period. In contrast, in Botswana, a similar change in the dependency ratio (from 1.05 to 0.65) was associated with a decline in economic growth rates (from 47 to 19 per 1000). In Kenya, changes in the dependency ratio associated with fertility changes were positively correlated with economic growth (ρ= +0.21), contrary to expectations. In addition, most African states are fragile, and susceptible to rapid reversals in economic growth, whatever the age structure. This is the case in countries severely affected by economic crises, such Angola, Chad, Congo (RDC), Liberia, Mozambique, Niger, Rwanda, and Zambia. Lastly, reverse causality is found in cases when economic growth attracts immigrants and therefore changes in the age structure: a typical case is Gabon, where fast economic growth in 1950-1969 was associated with low dependency ratios (0.59 to 0.65), whereas negative economic growth in 1980-1999 was associated with higher ratios (0.87 to 0.90). The matter is therefore complex, bi-directional, and susceptible to rapid change.

Micro-economic effects

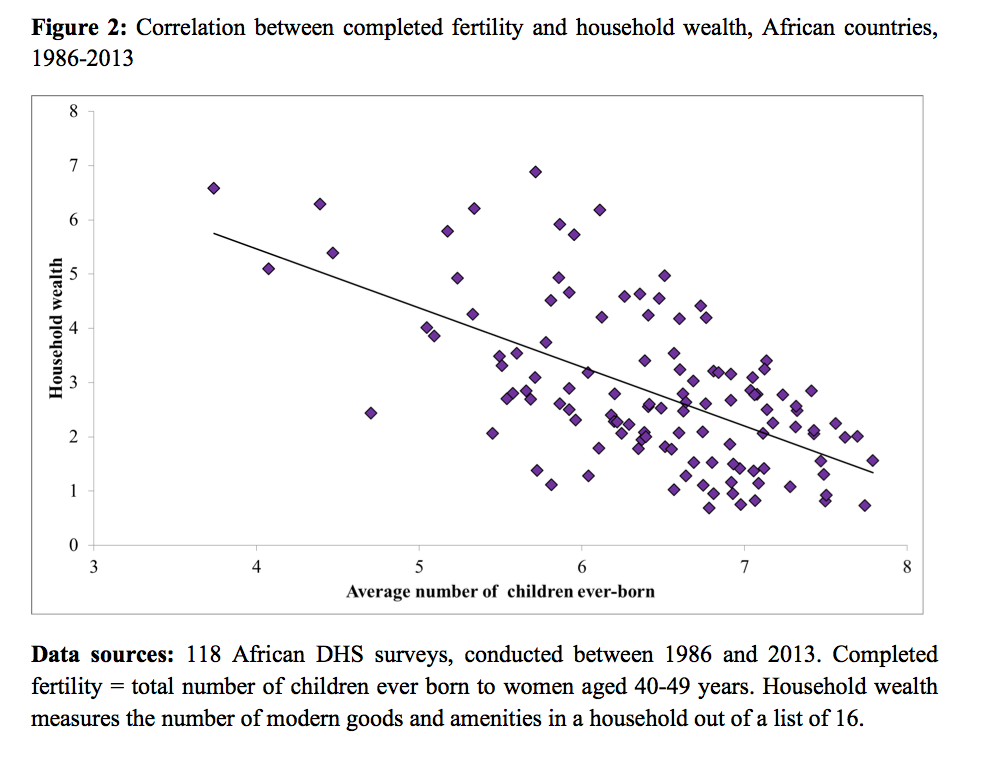

The lack of consistent macro-economic effects in Africa due to the structure of the economy does not imply that there are no positive effects of a low dependency ratio. These positive effects could be better shown at micro-economic level, that is at household level. Households which control their fertility, and have a smaller number of children, tend to be much better-off than those with large families. This can be easily demonstrated with data from DHS surveys: there is a strong negative correlation between household wealth and mean number of children ever-born among women at the end of their reproductive life (ρ= −0.96). Among the 119 surveys investigated, the correlation between complete family size and household wealth has almost always been negative in recent times. Exceptions are selected pre-transitional societies, such as Burundi 1987, Cameroon 1991, Malawi 1992, Niger 1992, Nigeria 1990; Rwanda 1992, Uganda 1988. But in these cases, the relationship applied to women born before 1950, still in natural fertility situations, for whom the distribution of family size was determined by primary and secondary sterility, and not by birth control, and therefore independent of wealth (Figure 2).

Conclusions

Debate on the demographic dividend in Africa has often been obscured by the lack of a proper analytical framework. By confusing longitudinal and cross-sectional approaches, and by focusing on macro-economic outputs, one could easily miss the most important dividend: that of limiting family size at household level. This is the level where the effects are most visible and consistent. This relationship is almost universal in developing countries, with many long term positive implications, not only for household wealth, education, savings, investments and economic growth, but also for the environment, and for peace and security.

References

Barro RJ. (1997). Determinants of Economic Growth: A Cross-Country Empirical Study. MIT Press, Cambridge, MA

Bloom D., Canning D., Malaney P. (2000). Demographic Change and Economic Growth in Asia. Population and Development Review; 26: 257–290.

Bloom D, Canning D., Sevilla J. (2002). The demographic dividend: A new perspective on the economic consequences of population change. Santa Monica, California: RAND, MR–1274.

Coale AJ., Hoover EM. (1958). Population growth and economic development in low-income countries. Princeton: Princeton University Press.

Easterlin RA. (1967). Effects of population growth on the economic development of developing countries. Annals of the American Academy of Political and Social Science. 369: 98-108.

Garenne M. (2016a). Demographic Dividend, Dependency Ratio, and HIV/AIDS in sub-Saharan Africa: Theoretical approach and case studies. A report to UNFPA Population and Development Branch. [Unpublished]

Garenne M. (2016b). La question du dividende démographique en Afrique au sud du Sahara. FERDI, Policy Brief No 164. (October 2016)

Johnson DG., Lee RD., eds. (1987). Population growth and economic development: issues and evidence. Madison: University of Wisconsin Press.

Kelley AC., Schmidt RM. (1996). Saving, Dependency, and Development. Journal of Population Economics; 9: 365-386.

Maddison A. (2010). The World Economy: a millennial perspective. Paris: OECD.

Mason A. (1988). Saving, Economic Growth, and Demographic Change. Population and Development Review; 14:113-144.

United Nations, Population Division (UNPD). (2012). World Population Prospects, the 2012 revision. New York, United Nations.